Snap also did not provide guidance for the current quarter as the “forward-looking visibility remains incredibly challenging.” Snap reported 347 million Global Daily Active Users (DAUs), slightly above the consensus projection of 344.2 million.

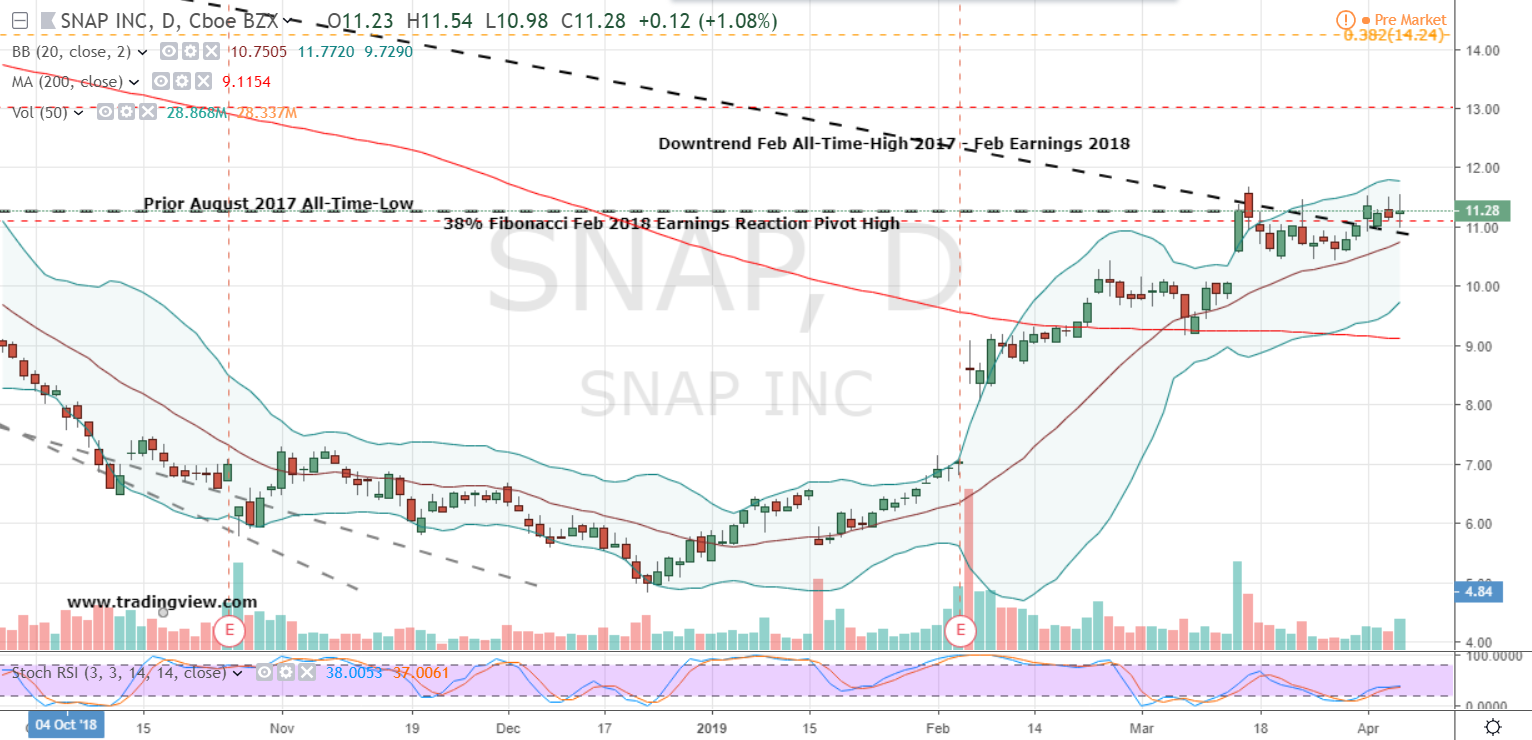

The company generated $1.11 billion in revenue, up 13% from the year-ago quarter, but below the analysts’ estimates of $1.14 billion. I previously covered the stock in March, when I rated it a strong buy on. Snap reported an adjusted loss per share of 2 cents in Q2, while analysts were projecting a loss per share of 1 cent. SNAP peaked above 80 per share but has somehow fallen 85 down to around 12 per share. Shares of Twitter are also in the red after the company missed revenue expectations and declined to provide guidance amid growing uncertainty around its deal with Elon Musk, who put the transaction on hold earlier this year. Snap’s report sent other major social media stocks declining including Meta, Alphabet, and Pinterest. The company’s shares plunged 35% at the market open, standing at $10.60 at the time of writing. Social media stocks lost a combined $80 billion Friday after Snap reported worse-than-expected second-quarter sales as advertisers cut back on spending.

Social Media Stocks Sharply Decline Following Snap’s Q2 2022 Report The report pushed Snap’s stock to its lowest mark since April 2020 and wiped a combined $80 billion from social media stocks. Shares of Snapchat’s owner Snap plummeted more than 35% at the market open Friday after the company reported disappointing Q2 2022 sales. Please consult our website policy prior to making financial decisions. Positive business developments and SNAP’S price chart point at a discounted growth. Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. By Chris Tyler, InvestorPlace Contributor Apr 1, 2022, 10:46 am EDT. Snap’s Stock Tumbles to a 2-Year Low on Disappointing Sales - The Tokenist Newsletter

0 kommentar(er)

0 kommentar(er)